Opportunity Zones

Background

Opportunity Zones are a community development program established by Congress in the Tax Cuts and Jobs Act of 2017 to encourage long-term investments in low-income urban and rural communities nationwide. The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones.

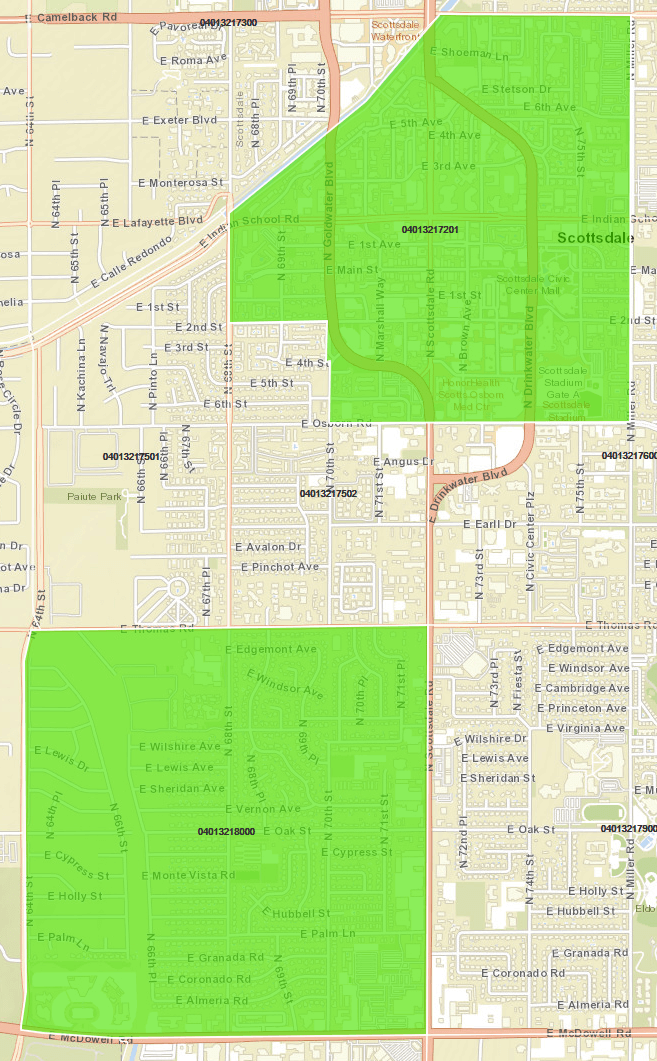

The Arizona Governor’s Office and the Arizona Commerce Authority worked with local governments, tribal communities, and counties to decide which census tracts would be submitted for consideration by the federal government. As of April 9, 2018, all of Arizona’s 168 submitted tracts became officially designated as Opportunity Zones. The Treasury has approved Opportunity Zones in all 50 states, five territories and Washington, D.C. There are two sites in Scottsdale that have been designated as Opportunity Zones.

Eligibility Requirements for a Qualified Investment in an Opportunity Zone

- The investment must be made via a Qualified Opportunity Fund. An Opportunity Fund is a privately managed investment vehicle organized as a corporation or a partnership for the purpose of investing in qualified Opportunity Zone Businesses. The fund must hold at least 90 percent of its assets in such property.

- The investment must be derived from a gain in another investment and transferred into an Opportunity Fund within 180 days of realizing the gain.

Tax Benefits for Eligible Investments

- If the investment is held for a minimum of five years, the taxable amount of the capital gains reinvested is reduced by 10%.

- If the investment is held for seven years, the taxable amount of capital gains reinvested is reduced by an additional 5%, bringing the total reduction to 15%.

- After holding for ten years, there is a permanent exclusion from taxable income on the capital gains from the investment in the Opportunity Fund.

What is a qualified Opportunity Zone Business?

A business in which substantially all of the tangible property owned or leased by the business is used in an opportunity zone, with at least 50% of the gross income earned by the business coming from the active conduct of business with an Opportunity Zone.

Examples of Qualified Opportunity Zone Businesses:

- Mixed use developments

- Market rate rental housing

- Parking facilities

- Retail/grocery stores

- Hotels

- Restaurants

- Sports facilities

- Health clinics

- Offices

- Manufacturing

Examples of businesses that do not qualify include:

- Private or Commercial Golf Course

- Country Club

- Massage Parlor

- Suntan or Hot Tub Facilities

- Racetrack or other establishment used for gambling

- Any store whose principal purpose is the sale of alcoholic beverages for consumption off the premises.

Example of Tax Benefits from Investing in Opportunity Zones

Investments held 10 years: taxable amount of the capital gains reinvested is reduced by 15% and no tax is owed on appreciation. For example: $100 of capital gains is reinvested into an Opportunity Zone fund in 2018 and held for 10 years. Tax owed on the original $100 is deferred until 2026, and taxable amount is reduced to $85 ($100 minus $15). Investor will owe $20 of tax on the original capital gains (23.8% of $85). No tax is owed on Opportunity Zone investment’s capital gain. Assuming a 7% annual growth rate, the after-tax value of the original $100 investment is $176 by 2028.*

Investments held 7 years: taxable amount of the capital gains reinvested is reduced by 15%. For example: $100 of capital gains is reinvested into an Opportunity Zone fund in 2018 and held for 7 years, selling in 2025. Taxable amount is reduced to $85 ($100 minus $15). Investor will owe $20 of tax on the original capital gains (23.8% of $85). Assuming a 7% annual growth rate, the investor will owe $15 in tax (23.8% of $61) on the Opportunity Zone investment’s capital gain.*

Investments held 5 years: taxable amount of the capital gains reinvested is reduced by 10%. For example: $100 of capital gains is reinvested into an Opportunity Zone fund in 2018 and held for 5 years, selling in 2023. Taxable amount is reduced to $90 ($100 minus $10). Investor will owe $21 in tax on the original capital gains (23.8% of $90). Assuming a 7% annual growth rate, the investor will owe $10 in tax (23.8% of $40) on the Opportunity Zone investment’s capital gain.*

* Source: Economic Innovation Group, 2018

Additional Resources

If you have additional questions regarding Opportunity Zones, contact the Arizona Commerce Authority at [email protected] and 602-845-1200.